Transfers of Funds / Expenses / Payroll

Transfers of funds (TOF) between FOAPALs are only allowed using the same fund number. For full list of exceptions, contact Finance.

One exception is if you provide support to another PI or campus program, an expense share TOE is allowed between research FOAPALs. It must be allowable on a contract and grant account.

Awards for travel, research and honoraria are possible for undergraduates, graduate students, post docs and faculty. Awards are handled based on employment status (if any), type of award and if the award is at UCSC or different UC campus. Most fund transfers show up in the financial system shortly after processing.

Contact Finance or your RA for assistance with any of these matters.

To submit a Transfer of Funds (TOF)

The requester must provide …

From

Source funding information including FOAPAL information, Amount and Description

Ex: FOAPAL: [FUND] - [ORG. CODE] - [ACCT CODE] - [ACTIVITY CODE]

Fund amount: $800.00

Description: Department transfering $800 in funds to support SlugTeam2018

To

FOAPAL information of where the funds are to be transferred to

Ex: FOAPAL: [FUND] - [ORG. CODE] - [ACCT CODE] - [ACTIVITY CODE]

Supporting Documentation

- Written authorization

- Reason for the transfer

- Name and contact information of person requesting the transfer

TOF requests should be directed to the Finance at be-finance@ucsc.edu. Please write clearly or type out the information for easy processing. If you wish to be notified upon completion of the transfer, please note this clearly on your submission.

Example of TOF Submission

Most expense transfers show up in the financial system shortly after processing and approval. Transfers of Payroll Expenses (TOPEs) post to the financial system once per month and show up a week or so after the beginning of the month.

Sometimes it is necessary to transfer an expense from one FOAPAL to another (for example, when a FOAPAL was charged in error). In that case, RA’s or Finance can enter a Transfer of Expense (TOE) or Transfer of Payroll Expenses (TOPEs).

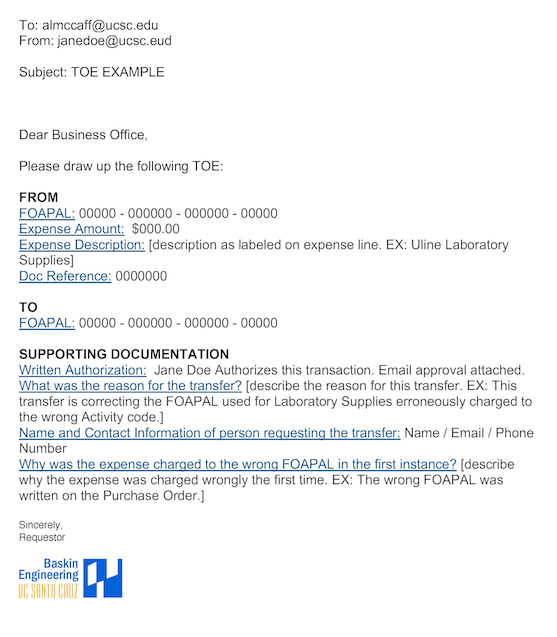

To submit a Transfer of Expense (TOE)

The requester must provide …

From

Individual Item of Expense to be transferred including FOAPAL and expense information

Ex: FOAPAL: [FUND] - [ORG. CODE] - [ACCT CODE] - [ACTIVITY CODE]

Expense amount: $88.88

Description: Uline - Laboratory Supplies

Doc Reference (if available): P0000000

To

FOAPAL information of where the expense is to be transferred to

Ex: FOAPAL: [FUND] - [ORG. CODE] - [ACCT CODE] - [ACTIVITY CODE]

Supporting Documentation

- Written authorization

- Reason for the transfer

- Name and contact information of person requesting the transfer

- Why the expense was charged to the wrong FOAPAL initially

TOE requests should be directed to the Finance at be-finance@ucsc.edu. Please write clearly or type out the information for easy processing. If you wish to be notified upon completion of the transfer, please note this clearly on your submission.

Example of TOE Submission

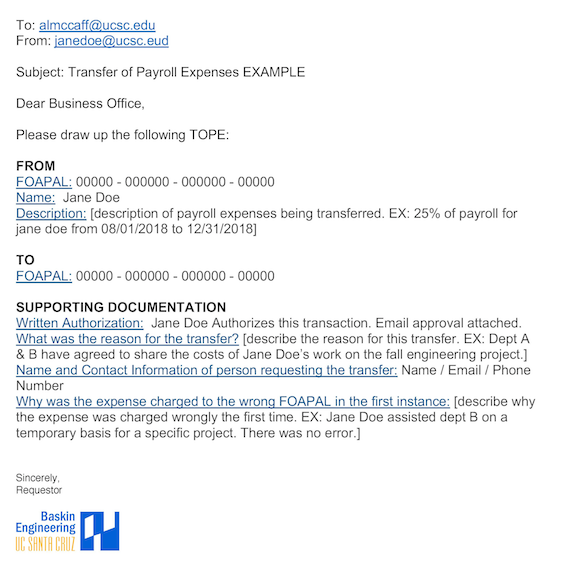

To submit a Transfer of Payroll Expense (TOPE)

The requester is to provide ...

From

Clear information as to what payroll expenses are to be transferred including FOAPAL information, name of employee and description. If a percentage is being transferred, please note this.

Ex: FOAPAL: [FUND] - [ORG. CODE] - [ACCT CODE] - [ACTIVITY CODE]

Name: Jane Doe

Description: 25% of payroll and salaries from 08/01/2018 to 12/31/2018

To

FOAPAL information of where the payroll expenses are to be transferred to

Ex: FOAPAL: [FUND] - [ORG. CODE] - [ACCT CODE] - [ACTIVITY CODE]

Supporting Documentation

- Written authorization

- Reason for the transfer

- Name and contact information of person requesting the transfer

- Why the expense charged to the wrong FOAPAL initially

TOPE requests should be directed to the Finance at be-finance@ucsc.edu via email. Please write clearly or type out the information for easy processing. If you wish to be notified upon completion of the transfer, please note this clearly on your submission.

Example of TOPE Submission

Each transfer must meet the following:

-

Relate to individual items of expense or funding.

-

Refer to a source document in detail sufficient to link the transfer to the original funds or expense.

-

Match the amount as originally recorded or an appropriate portion.

-

Provide supporting documentation for the purpose of the transfer, not the original charge.

-

Transfer must be fully explained (who, what, when, where, why):

- Who - written authorization from you is required except for clerical errors.

- What was the reason for the transfer? How does the expense fall within the scope of the FOAPAL?

- When - A sound justification is required for transfers older than 120 days after the original expense or funding.

- Where - name and contact information of person processing the transfer.

- Why was the expense charged to the wrong FOAPAL initially?

Finance or your RA can assist you with developing the required supporting documentation. Payroll expenses can also be moved between FOAPALs using the same documentation shown above.